Riding the ripple of Japanese beef imports to Australia

The recent lifting of the ban on imported Japanese beef into Australia has many in the Wagyu industry curious about what impact it will have on domestic business.

In short, it may impact a little on suppliers into high-end steak, Japanese and Korean cuisine restaurants, but beyond that, it is not likely to be significant.

There are a few reasons why this is the case.

In a recent consultation between the Australian Wagyu Association Board with MLA’s Miho Kondo, Market Insights Manager for Japan and Korea and Andrew Cox, MLA’s Business Manager based in Japan, the sentiment was clear that Japan had a few hurdles to overcome for export to Australia to be viable.

AWA CEO Dr Matthew McDonagh said that “the original ban was put in place in 2001 after an outbreak of bovine spongiform encephalopathy (BSE) in Japan, to protect Australia’s biosecurity. In a media release from DAWR in early June 2018, the department approved the ‘recommencement of chilled or frozen beef imports from Japan’ – provided all the necessary measures were in place to mitigate identified risks.”

According to Andrew Cox, the major exporters in Japan are not rushing ahead to export to Australia, principally because the Australian market does not represent a significant commercial opportunity. The focus of the Japanese beef industry is to target countries such as Taiwan, which has a significant number of Japanese cuisine restaurants and demand for Wagyu is high.

So just how much beef does Japan export and to where?

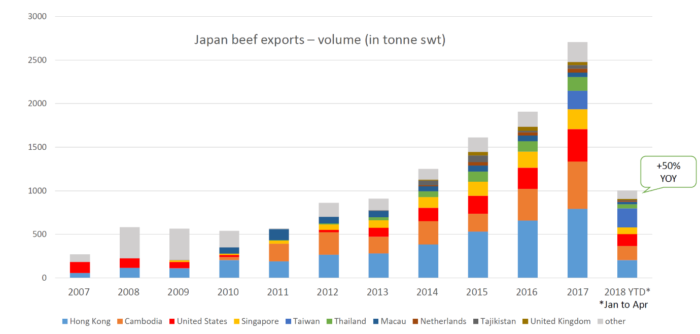

Analysis by Miho shows that markets such as Hong Kong, USA and Singapore are the primary export countries for all Japanese beef, while Cambodia and Tajikistan show significant levels but are believed to be grey markets into China. Since Taiwan opened its doors in 2017, it is now the fifth-largest market for Japanese beef.

“Prior to BSE in the Japanese herd in 2001, the last full year of Japanese beef exports to Australia was less than 500kg,” said Andrew. “The highest level was around 750kg in the late 1990s.

“Given that things have changed since then and Japan is now more geared toward exports, the output is now around ten times what it was in the late 1990s. The Australian landscape has also changed in that time with a greater foodie culture that would take on products such as Wagyu. The cost of importing Wagyu into Australia would put the Japanese product at a higher price than locally produced Wagyu.

“The feeling in the commercial space is not one of great excitement. Exporting to Australia is more about the kudos for the Japanese beef industry that they have cracked our stringent biosecurity nut and potentially made it easier to transition into other markets. We don’t see Japanese beef imports into Australia as a huge competitor.”

Japanese in-house hurdles

Australia’s biosecurity measures are well known to be one of the toughest in the world and Japanese exporters will still need to ensure that all the accreditation boxes have been ticked before shipments can commence.

The discussion with Andrew and Miho however, suggests that challenges within Japan to be a strong exporter will be more of a hindrance than biosecurity.

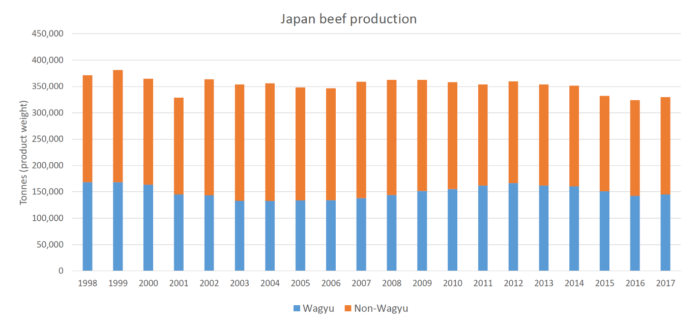

It appears that overall Japanese beef production is in gradual decline, with two key reasons. The first is a recent trend for the younger generation to move away from high-end products such as Wagyu for general consumption in preference for leaner, cheaper meats.

The Ministry of Agriculture, Forestry and Fisheries (MAFF) in Japan aims to maintain 2015 levels of beef production and indications suggest it may be difficult to attain. The best way to ensure long term viability is to intertwine a strong export market and promote greater domestic consumption said Andrew.

This in itself presents a challenge as Japanese beef producers compete and promote products based on their prefecture making it difficult to implement an over-arching government strategy to sell Wagyu to the domestic and international consumer.

“A national strategy makes sense from an export point of view, and successful trade shows into Europe and the US have shown the Japanese government can do it, but with the ongoing disconnect between prefectures, supply and the international strategy, Japan has a few challenges to overcome to develop new export markets. It will be a while yet before it has impact on Australian shores,” said Andrew.